On-chain data shows that Bitcoin whales have continued to buy even at recent highs, a sign that could be bullish for the rally.

Bitcoin Large Holders Netflow continues to see positive spikes lately

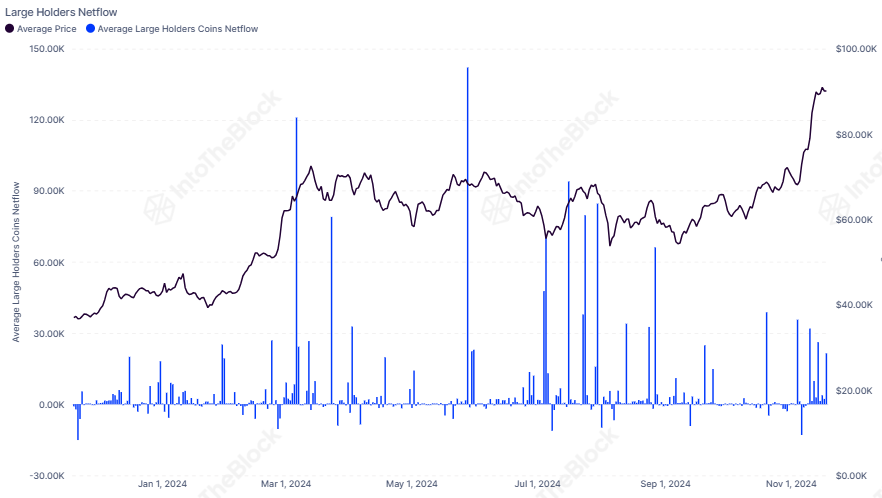

This is evident from data from the market information platform InTheBlokthe number of BTC whales has recently increased. The on-chain metric of interest here is the “Large holders Netflow”, which tracks the total amount of Bitcoin flowing into or out of the wallets of large holders.

IntoTheBlock defines “Large holders” as investors who own at least 0.1% of the cryptocurrency’s supply. Today, there are approximately 19.8 million tokens of the asset in circulation, so holders who qualify for this cohort would own at least 19,800 BTC.

At the current exchange rate, this amount of asset equates to approximately $1.8 billion. So the investors who fall into this category would be quite large indeed.

In general, each investor’s influence on the market increases the more coins he owns, so the Large Holders with their huge balances would contain the most influential entities on the network. As such, the behavior of this cohort may be worth keeping an eye on.

When the Large Holders Netflow has a positive value, these giant investors observe the inflow of a net amount of coins into their wallets. This purchase could obviously be bullish for the asset.

On the other hand, the negative indicator suggests that large holders are reducing their holdings, which could lead to bearish action for the cryptocurrency.

Here is a chart showing the trend in Bitcoin Large Holders Netflow over the past year:

The metric appears to have witnessed a few green spikes in recent days | Source: IntoTheBlock on X

As the chart above shows, the Bitcoin Large Holders Netflow witnessed massive spikes earlier this year as the whales were busy amassing the assets.

Interestingly enough, as BTC’s latest run is to new all-time highs (ATHs) has taken place, the indicator has again experienced positive peaks. The size of these latest net purchases was significantly smaller than the earlier ones, but the fact that these investors did not sell at all is certainly positive for BTC.

The net accumulation obviously reflects the whales’ confidence in the cryptocurrency right now, given that the purchases were made while BTC was already trading at higher prices than ever before in history.

It now remains to be seen whether this accumulation of Bitcoin Large Holders would cause a continuation of the run or not.

BTC price

At the time of writing, Bitcoin is trading around $92,600, up more than 7% in the past week.

Looks like the price of the coin has been moving sideways over the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com