In a surprising twist, the terrorist group Islamic State (IS) now advocates the use of cryptocurrency A new report finds that the terrorist organization’s terrorist acts should be supported as long as they adhere to the principles of Sharia law.

Compiled by the Analytical support to the UN and the Sanctions Monitoring Team, the research found that IS affiliates are demanding that the digital assets they increasingly use to support their activities be checked for Sharia compliance.

This is a major change, as Sharia law has always been against cryptocurrencies. The UN report further highlights the thorough guidelines that ISIS provides to its operatives for crypto transfers. To facilitate these transactions, the terror group has even created specialized channels on the Telegram messaging service, such as CryptoHalal and Umma Crypto.

Sharia Compliance with Blockchain

Sharia law, the religious law that stems from Islamic beliefs, has long been at odds with cryptocurrency. The distributed nature of digital assets and their widespread use for gaming and other illegal activities have historically made them incompatible with Sharia values.

However, the UN assessment implies that IS is now seeking compromises to enable IS cryptocurrency to be more Sharia-compliant. Stricter rules and oversight can help ensure that the money is not used for illegal activities or to support terrorism.

Total crypto market cap at $2.16 trillion on the daily chart: TradingView.com

Implications for the crypto sector

The Islamic State’s push for Sharia-compliant crypto could have major implications for the entire bitcoin market. There could be increased demand for additional scrutiny and monitoring of the crypto ecosystem as more terrorist groups and other illicit entities attempt to leverage digital assets.

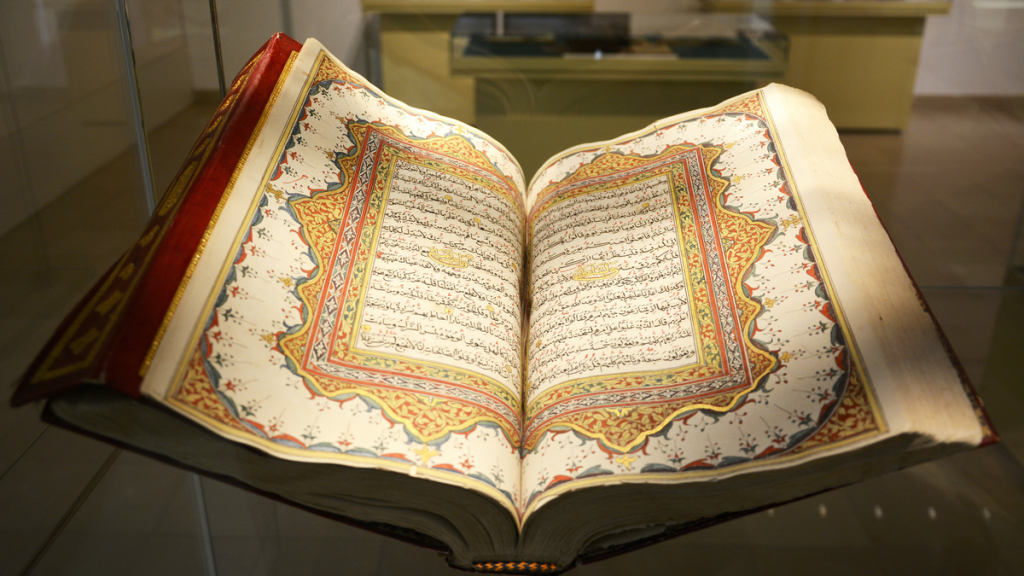

Image: GV Wire

Stronger know-your-customer (KYC) and anti-money laundering (AML) policies may be required from exchanges, wallet providers, and other cryptocurrency service providers to prevent their platforms from being exploited for terrorist financing. This could result in higher compliance costs and potentially limit the availability of cryptocurrencies to legitimate consumers.

A worrying development

The alarming growth in the Islamic State’s demand for Sharia law concessions for cryptocurrencies underscores the ongoing efforts by terrorist groups to use digital assets for their sinister purposes. Regulators, law enforcement, and industry players will be especially important as the crypto sector evolves to help mitigate the dangers posed by terrorist financing and other illicit activities.

The UN study reminds us that we must maintain a strong and secure crypto environment that is resilient to malicious abuse.

Main image of Spiegel, chart from TradingView