Data shows that the Bitcoin futures-to-spot trading volume ratio has fallen 63% since the peak of the last bull market. Here’s what it means.

Bitcoin Futures Market Occupies Lower Volume Share This Rally

As explained by CryptoQuant founder and CEO Ki Young Ju in a new after On X, the BTC market appears to be less futures-driven than during the previous bull run.

The interesting metric here is the “futures-to-spot trading volume ratio,” which, as the name suggests, tracks the ratio of Bitcoin futures to spot trading volumes.

The trading volume of course refers to the total amount of cryptocurrency traded on the various exchanges in the sector.

When the ratio value is high, the futures market sees more trading volume than the spot market. Similarly, low values imply the dominance of spot trading in the sector.

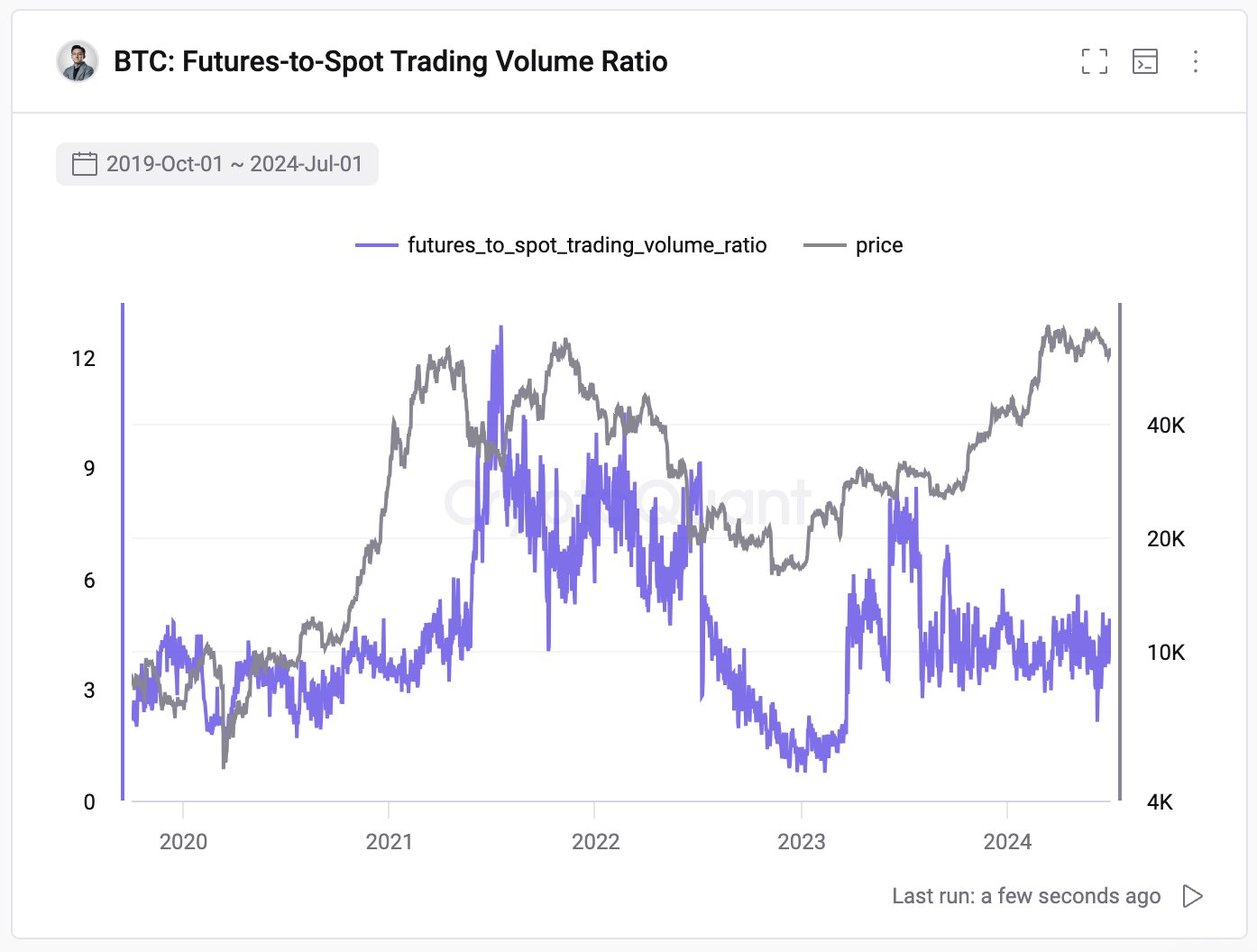

Below is a chart showing the trend in the ratio of Bitcoin futures to spot trading volume over the past few years:

The value of the metric appears to have been moving sideways in the last few months | Source: @ki_young_ju on X

The chart above shows that the ratio of Bitcoin futures to spot trading volume has risen to quite high levels over the past few years. 2021 boomMore specifically, the indicator had crossed above the 12-mark at its peak, meaning that futures volume exceeded spot trading by more than twelve times.

After this top, the metric cooled down during the second half of the 2021 bull run, but remained at elevated levels. These elevated levels then continued into the first half of 2022.

Like the bear market lows had been reached, but the metric had fallen as interest in speculative activity surrounding the cryptocurrency had waned. With the 2023 recovery run, the indicator saw some uptick, hitting the same levels as in the first half of 2022 in June.

However, since then the ratio has fallen back to relatively low levels and has continued to consolidate until now. Compared to the peak of 2021, the indicator’s value has fallen by about 63%.

Futures trading volume is still the dominant force in the market, but much less than in the 2021 bull run, implying that speculative interest has been relatively cool in the rally. CryptoQuant’s founder believes this move toward higher spot trading volume is good for the market.

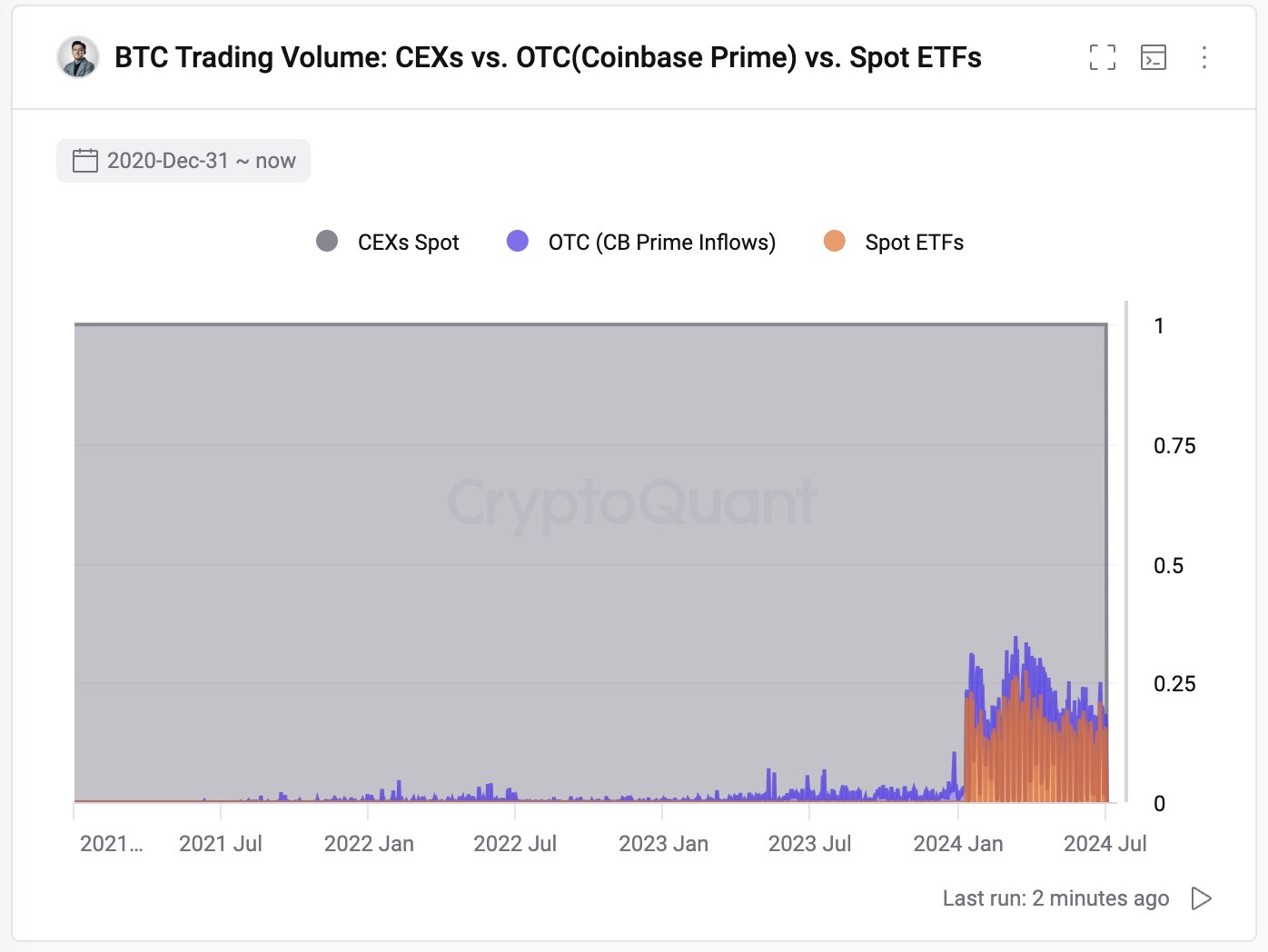

In this latest cycle, however, there is also something else: the emergence of a new way to trade Bitcoin: spot exchange-traded funds (ETFs). So, how does the volume of these financial instruments compare to the spot market?

Like Ju in another X- afterThese ETFs currently account for almost a quarter of total spot trading volume.

The ETF volume of BTC stacked against its spot trading volume | Source: @ki_young_ju on X

BTC price

Bitcoin has dropped more than 4% over the past 24 hours, pushing its price to $57,300.

Looks like the price of the coin has been going downhill in recent days | Source: BTCUSD on TradingView

Main image from Dall-E, CryptoQuant.com, chart from TradingView.com